|

|

|

|

Looking Forward

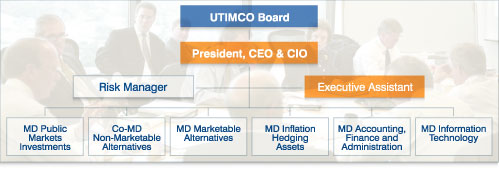

Value-added investing success will separate those endowments able to cope and even flourish in the challenging markets ahead from those that will stagnate and lose competitive edge. It is very important to remember that investment markets are highly competitive and investors must continually improve just to maintain their current competitive positions. A helpful mental picture is a down-escalator as a metaphor for competitive position in investment markets. Organizations simply maintaining status quo will ultimately end up at the bottom of the escalator at the lowest competitive position as would an individual standing still on a down-escalator. However, organizations intent on improving competitive position must not only improve at the overall rate of the markets, the pace of the escalator, but actually improve faster than other competitors, thereby moving up the down escalator. It takes a lot of energy to run up a down-escalator; it takes a great deal of organizational energy to improve and maintain competitive position, but the payoff to improvement is large. Competitive, successful, value-added organizations attract better investment talent, get access to the best external managers and partnerships, are better able to adapt to changing market environments, and earn consistently higher returns. Value-added investing will be the key to success not only in allowing UTIMCO to meet our return targets despite the intermediate term challenges we anticipate, but over the long run as well in allowing us to improve our competitive position in investment markets, improving the odds that we can meet and exceed both current and future needs of endowment beneficiaries. To provide the energy and focus necessary to improve our competitive edge, UTIMCO has specialized and decentralized its organizational structure as shown in the chart below. With experienced and skilled investment experts now responsible for asset category segments, the new structure provides the depth of expertise necessary to compete successfully within asset categories and the flexibility necessary to adapt to changing market conditions. The President, Risk Manager, and Managing Directors work as a senior management team to move UTIMCO up to a higher competitive position on the financial markets down-escalator. Successful value-added investing requires skill, creativity, flexibility, commitment, and tenacity. Neither investment art nor science alone is enough. Our goal at UTIMCO is to use both art and science, as well as the essential traits of successful value-added organizations, to build and maintain our competitive position so that we can earn the returns necessary to help build the legacies established by the endowment funds of The University of Texas System. |

|