Letter from the CEO & Chief Investment Officer

Fiscal Year 2015 Returns

The Permanent University Fund (the �PUF�) and the General Endowment Fund (the �GEF�) � together the �Endowments� � had investment gains of 0.43% and 1.08%, respectively, for the fiscal year ended August 31, 2015 (�2015�).

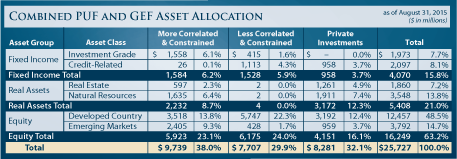

PUF assets totaled $17.5 billion and GEF assets totaled $8.2 billion at fiscal year-end. This represents an all-time peak for the PUF. Combined with the other funds managed by UTIMCO, namely the Intermediate Term Fund (ITF), and the Short Term and Debt Proceeds Funds, UTIMCO�s assets under management totaled $35.2 billion, also an all-time peak.

The Endowments� actual returns exceeded the Policy Portfolio Benchmark by 1.80% for the PUF and 2.45% for the GEF. Although the ITF experienced a loss of -3.28%, actual returns exceeded its Policy Portfolio Benchmark by 1.83%. As a reminder, the Policy Portfolio Benchmark represents the returns that would result without UTIMCO staff (�Staff�), or said precisely, the investment returns that would be realized if each asset class was at its Policy Portfolio target weight and generated that asset class� average returns.

Over the past five years, the funds� actual returns have outperformed the Policy Portfolio Benchmark by an average of 1.32% per year for the Endowments and 1.82% for the ITF, resulting in $415 million per year of additional resources for the UT and A&M Systems. In 2015 alone, $648 million of additional resources were generated.

UTIMCO analyzes other top endowments in order to identify �best practices�. Over the last year, the Endowments� investment returns approximated the average endowment and slightly lagged other large endowments, primarily due to the Endowments� lower risk profile versus other large endowments as manifest most explicitly by our smaller percentage of assets in private investments, and venture capital in particular.

Staff, the UTIMCO Board (�Board�) and The University of Texas System Board of Regents (the �Regents�) have all concurred with having a less-risky portfolio, particularly given global economic uncertainties. Although the goal of protecting principal supersedes the desire for higher investment returns, in an effort to preserve purchasing power, the Endowments� risk profile has gradually and prudently increased over the past eight years, and it is anticipated to continue to do so.

Investment Strategy

Readers of previous Annual Report letters may observe that this part of the annual letter has remained consistent � and will again this year. This is because as a long-term investor our investment strategy remains relatively constant while our implementation is flexible in order to take advantage of capital market opportunities.

Our core investment principles, and therefore strategy, include beliefs that:

A diversified portfolio produces the best risk-adjusted returns, therefore we invest across investment styles, geographies and asset classes;

- Skill matters when investing, therefore we continue to partner with the best investment managers;

- Equity outperforms fixed income over the long term, therefore we have an �equity orientation�, while recognizing that during certain periods fixed income can present attractive risk-adjusted returns;

- As an �in-perpetuity� investor, we have a long-term horizon enabling us to earn an illiquidity premium by assuming reasonable levels of illiquidity risk;

- A bias toward value is prudent, providing a margin of safety;

- Capital markets are subject to supply and demand imbalances so we look to take advantage of favorable imbalances;

- Emerging market economies comprise approximately half of the world�s GDP and will continue to grow over the long term, albeit likely at slower rates than experienced over the past few decades; and

- Real assets � real estate and natural resources � present attractive investment opportunities in certain economic circumstances, as well as a �third leg� of diversification with stock and bonds.

Click to print charts in this section using PDF format

Every year we engage in a thorough review of our Investment Policies (�Policies�) with our Board and the Regents, as all Policies are at the discretion of the Regents.

This year we also further enhanced our reporting to our Board and the Regents to explicitly address ten risks we identified as top priorities, including:

- Underperformance

- Market

- Volatility

- Scenarios

- Leverage

- Permanent Loss of Capital

- Active Management

- Transparency

- Concentration

- Illiquidity

Portfolio Positioning and Tactical Allocations

The portfolio is positioned as follows:

- Approximately 6.1% of the portfolio is invested in More Correlated and Constrained (�MCC� or long-only) Investment Grade Fixed Income. This part of the portfolio provides liquidity and diversification.

- The MCC Natural Resources portfolio totals 6.4% and is roughly evenly split across gold, broad commodity trading strategies and natural resources-related public equities.

- MCC Real Estate, totaling 2.3%, brings core real estate exposure to the overall portfolio through investments with REIT investment managers.

- MCC Developed Country Public Equity exposure includes mandates focused on high-quality global companies as well as mid and small capitalization companies. This exposure represents approximately 13.8% of the total Endowments.

- MCC Emerging Market Public Equity contains mandates with global, regional or country-specific emerging market investment mandates. These managers rely on a disciplined investment approach and local market-specific insight. The Endowment exposure in this portion of the portfolio is 9.3%.

- The Less Correlated and Constrained (�LCC� or hedge fund) book, at 29.9% of total assets, remains a very large allocation for the Endowments. UTIMCO has a diversified portfolio of just over forty hedge fund managers employing a variety of investment strategies including long/short equity, multi-strategy event-driven, credit, and global macro approaches. The LCC exposure generates �equity-like� returns with low correlations to its underlying asset classes. Our LCC external managers use modest levels of leverage, provide substantial portfolio transparency, practice strong risk management, and generally approach investing with a value bias based on superior fundamental research.

- UTIMCO�s Private Investments portfolio increased to 32.1% of total assets, spanning a broad range of asset classes including illiquid credit, real estate, natural resources, buy-out, growth and venture equity. One measure of the portfolio�s success is that in 2015, distributions of $1.722 billion almost kept pace with capital calls of $1.831 billion. During 2015, Staff made $3.2 billion of new commitments to just under fifty external managers, including co-investments.

- Illiquid credit exposure continues to recede as investments are monetized.

- Real estate and natural resources-related private equity exposures continue to increase as Staff identifies and partners with talented managers to exploit attractive market opportunities.

- More traditional private equity exposure remains steady as new investment opportunities are identified in our focus area in the lower middle market, while legacy portions of the portfolio continue to recede.

- Venture capital market exposure increased, even after distributions exceeded capital calls, on the heels of an annual investment return of 53.5%.

- Emerging market growth-oriented private equity again increased as Staff continues to seek skilled partners with whom to invest in this potentially rewarding area.

During 2015, actual investment performance beat the Policy Portfolio by 1.80% in the PUF and 2.45% in the GEF, despite tactical allocation and portfolio hedges detracting 10 basis points. Tactical allocation refers to Staff�s positioning of investments in specific asset classes over or under Policy targets, but always within specified ranges. For the most part, the portfolio is invested close to target and undergoes modest, incremental changes over the course of the year.

Active Management

Active management refers to the actual returns generated by our external investment managers relative to the passive or average returns in their respective markets. These efforts generated additional returns of 1.96% for the PUF and 2.55% for the GEF in 2015 over market average returns.

UTIMCO Staff focuses the vast majority of our effort on partnering with �best in class� managers in order to deliver this level of �value added� returns. One set of metrics underscoring this is that Staff participated in over 1,575 meeting with prospective investment managers and almost 1,800 meetings with existing managers during the year. These meetings are in addition to the materials that were reviewed and analyzed on existing and new investments, as well as the basic market research that is conducted on an ongoing basis.

- The MCC Investment Grade Fixed Income portfolio, excluding the Liquidity Reserve, outperformed its benchmark by 2.0% as the market experienced an average gain of 6.2% and our portfolio was up 8.2%. This level of outperformance is stellar in this area of the capital markets and has been sustained over the past five years.

- The MCC Real Estate active managers suffered a loss of -8.6%, significantly underperforming their benchmark by -3.8%. The below benchmark performance was due to a single manager in their first year in our portfolio. We are closely monitoring this new manager.

- The MCC Natural Resources public equity portion of the portfolio was down -43.1, -8.3% below its benchmark, and the commodity portfolio was down -32.6%, -4.5% worse than its benchmark. Natural resources were hard hit over the past year and our mid/small cap equity portfolio exhibited greater volatility than its benchmark, resulting in relative underperformance during the global resources equity rout. Historically, this portfolio has likewise outperformed during a sector recovery. Our actively managed commodity strategies underperformance was unexpected, as these strategies were designed with a wide variety of tools to allow our manager to outperform in any market conditions. As such, we are devoting a great deal of attention to re-underwriting this part of the portfolio.

- The MCC Developed Country Public Equity portfolio generated returns of 4.9%, 9.0% better than the market average -4.1% return. Over the past five years this portfolio has outperformed its benchmark by 4.4% per year, which is outstanding.

- The MCC Emerging Markets Public Equity portfolio was down -12.5%, although it substantially bested its benchmark return of -22.9%. Over the past five years, this portfolio has outperformed its benchmark by 4.0% per year, which is outstanding.

- The LCC portfolio posted a 3.0% return, exceeding the 1.6% average fund of fund benchmark. This portfolio continues to generate top quartile returns, with a five year average annual outperformance of 4.3% versus its benchmark, which is outstanding.

- Private Investments generated returns of 13.4%, roughly in line with market average returns. Venture Capital led the way with a whopping 53.5% return, followed by Real Estate with a 20.2% return, the non-venture capital Developed Equity portfolio with an 11.9% return, Emerging Market equity with a 6.9% return, and Credit with a 5.9% return. The only illiquid investment asset class that suffered a negative return was Natural Resources with a -2.5% performance, which is quite laudable given the overall natural resources markets, and far ahead of the asset class-specific benchmark.

Staff has embarked on a number of new initiatives aimed at producing above average returns, including, but not limited to:

- Co-investments: with the objective of increasing concentration with our highest conviction partners in their highest conviction ideas, and at lower fees, Staff made 14 co-investments alongside our partners totaling $384 million during the year, and 50 investments totaling $1.1 billion since the program was started a few years ago. While still early in its life, based on realizations received thus far, along with the valuation of the unrealized portion of the portfolio, this initiative appears likely to generate accretive returns to the portfolio.

- Country-specific emerging market managers: ith the objective of capturing higher returns, Staff continues to shift the MCC emerging market portfolio away from global emerging market managers toward regional and country-specific managers including partners in India, Mexico, South Korea and Southeast Asia. Over 75% of our emerging market public equity exposure is now with country or region specific partners.

- �Next Generation� hedge fund managers: with the objective of sustaining top quartile performance for years to come, Staff has invested over $3.4 billion with 19 managers that are younger, have shorter standalone track records and have fewer assets under management than our average LCC partner.

- �Sponsoring Partnerships�: with the objective of obtaining greater exposure with managers of smaller funds at advantaged economics, Staff has expanded its efforts to identify and partner with talented investment managers early in their efforts to create their own independent investment organizations. To illustrate this, UTIMCO has forty relationships totaling over $4 billion of invested capital with partners where UTIMCO�s capital represents twenty percent or more of the partners� total capital, and another 57 relationships where UTIMCO�s capital accounts for ten to 19.9% of the partner�s capital.

2015 Market Recap and Future Outlook

Central banks� action � or inaction � continued to dominate capital markets: the US Federal Reserve kept saying it really, really, really would tighten � (at some point and to some extent) and it appears they will (finally) start to make good on their intentions in December, 2015. In contrast, the ECB continues to say and do �whatever it takes� to stimulate the �Old World� economies, and Japan remains committed to inflating its economy until the sun does indeed set.

China became an even bigger global factor with its slight but abrupt currency devaluation in August and its large multi-decade over-investment binge: a �pivot� from exporting to consuming is not likely to be delicate when executed in a country of over a billion people. India continued to demonstrate the challenges inherent in a democracy with a billion plus citizens, although it does appear to be heading along a constructive economic path. Brazil is reeling from a consumption binge fueled by Chinese demand for its commodities and exacerbated by a lack of fiscal discipline and a corruption scandal consuming its leadership. Russia, while rattling its sabre, has had its economy rattled by plummeting oil prices and punishing sanctions.

Outside of the U.S. equity markets, returns in U.S. dollars (�USD�) were significantly affected by USD strength, as the U.S. Dollar Index and the U.S. trade-weighted dollar index increased by 15.8% and 14.0%, respectively, during the year.

Not surprising with this economic backdrop, the Barclays Global Bond Index lost -6.4%, the TIPs Index lost -2.7% and the High Yield Bonds Index lost -4.7% over the twelve months ending August 31, 2015.

REIT indices fell by -4.8%.

Broad-based commodity indices fell -28.1% over the fiscal year, driven by Saudi-led oil production coupled with cooling Chinese demand for metals. Oil spot prices were down -48.7% and gold was down -12.0% for the year.

In public equities, the S&P 500 eked out a 0.5% gain, while Euro Stoxx was down -12.2% and the Topix indexes rose 3.2% during the fiscal year. The MSCI Emerging Market Index was down -22.9% for the year, led by Brazil (down -53.1%), Russia (down -30.0%) and India (down -9.9%), while China was the lone standout, rising 38.5% despite an end of fiscal year sell-off.

Many emerging markets had a tough year, as lower natural commodity demand prices weighed heavily on commodity producing nations and a strong dollar weighed heavily on countries with dollar debt.

As Yogi Berra famously observed: forecasting is difficult, especially about the future, so our perspectives about the future will be general and long term.

Asset prices strike us as high, stimulated by easy money and the stretch for returns on the part of many investors. Our response is to cautiously continue to invest for the long term.

TAs we have articulated in previous Annual Letters, �Long Workout, Long March� remains our operating framework.

Although capital markets were strong for many years, albeit with a softening this past year, the developed world debt picture remains unattractive. The debt overhang is a strong headwind to long term economic growth. A �Long Workout�, however, does present investment opportunities as stressed sellers are forced to offer good assets with bad balance sheets to those with the capital to invest. Pockets of growth, particularly in certain areas of technology, including health care, continue to present themselves even in a challenging macro environment.

The �Long March� thesis noted that progress will be neither linear nor stable, as this past year certainly confirmed. It remains the case, however, that billions of people in Asia, South America and Africa will continue to �get in the game�, both producing and consuming goods and services. This fundamental, long-term, dynamic presents enormous potential investment opportunities.

As long-term investors, we remain committed to an investment approach that takes advantage of long-term, secular themes.

Board and Staff

The Board and staff are the keys to UTIMCO�s investment success.

We are grateful for Morris Foster�s service on the UTIMCO Board, including as Chairman, and we are grateful to Jeff Hildebrand for assuming UTIMCO Board Chairmanship. We are also grateful for Chancellor Cigarroa�s and Bobby Stillwell�s service on the UTIMCO Board. We welcome Chancellor McRaven, Phil Adams and David Beck to the UTIMCO Board.

We appreciate the oversight, direction and support we receive from the UT and A&M Regents, and we are grateful for the open communications UTIMCO has with our colleagues at the UT and A&M Systems and their respective institutions.

Personally, I cannot express enough gratitude to my colleagues on the UTIMCO Staff, many of whom have now worked together for the better part of a decade to continuously enhance results.

Senior investment Staff is fully in place, seasoned, and integrated. Our investment teams are more than ably led by tremendously talented investors, with most teams having at least one senior investment professional in addition to the team leader.

We are also making good progress on expanding the areas where we believe we have domain expertise. We have added senior investment professionals in areas including the health care, agriculture, and metals and mining sectors, as well as in emerging markets, to complement the strong expertise we have in areas such as IT venture capital, lower middle market private equity, real estate and natural resources. And our fixed income, public equity and hedge fund expertise is second-to-none.

The major enhancement to our information technology platform we began a few years ago is making good progress, and we continue to be blessed with very strong and devoted support and control colleagues.

We are pleased to have had a positive, albeit small, year of investment returns. We believe we are prepared for the vagaries, challenges and opportunities the markets will offer. We are committed to doing our best, each and every day.

|

|

Bruce Zimmerman

Chief Executive Officer and

Chief Investment Officer

|